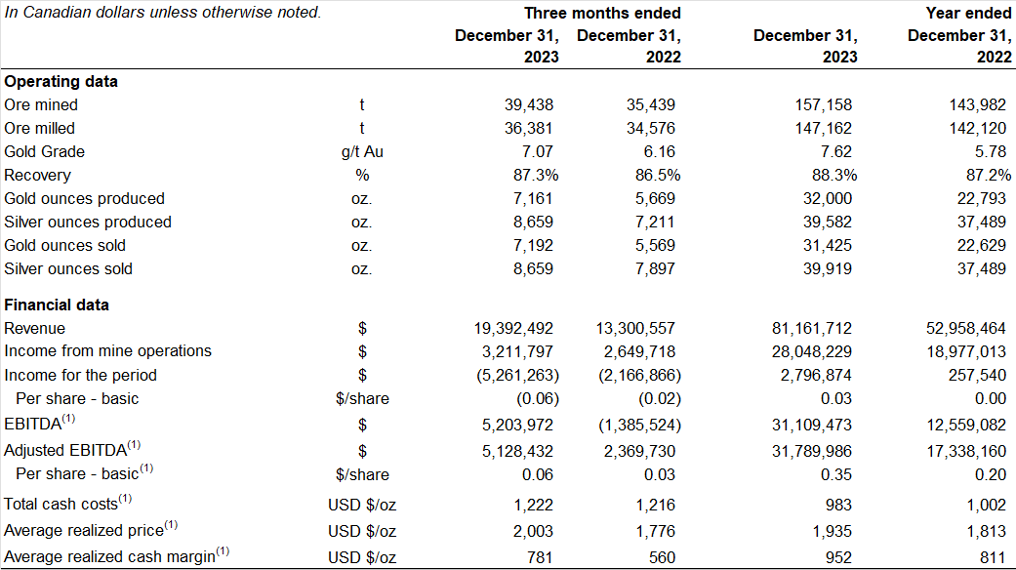

- A record 32,340 AuEq ounces were produced in 2023 – a 40% increase from the previous year. Q4-2024 AuEq production was up 25% to 7,234 ounces.

- Revenue for the year rose by 53% to $81.1 million. Income for 2023 reached $2.8 million, compared to $0.3 million in 2022. Q4-2024 revenue climbed 46% to $19.4 million.

- Adjusted EBITDA(1) reached $31.8 million, an 83% increase over the previous year. For Q4-2024, Adjusted EBITDA(1) of $5.1 million was 116% higher than Q4 of 2022.

- Total cash costs per ounce of gold sold(1) for 2023 was US$983, slightly lower than the US$1,002 reported in the previous year.

April 30, 2024, Vancouver, British Columbia – Soma Gold Corp. (TSXV: SOMA) (WKN: A2P4DU) (OTC: SMAGF) (the “Company” or “Soma”) is pleased to announce that the Company’s Financial Statements and MD&A for the Years Ended December 31, 2023 and 2022 have been filed on SEDAR+ and are available on the Company website.

2023 Operational and Financial Highlights

- Total AuEq production of 32,340 ounces from the Cordero Mine and the el Bagre Milling Operations.

- Cordero Operations had an attributable cash cost per ounce of gold sold(1) of US$983 and an All-In Sustaining Cost (AISC)(1) of US $1,510 per ounce.

- Income from mining operations reached $28.0 million.

- Total Comprehensive income stood at $11.5 million compared to a loss of $2.6 million in 2022.

- EBITDA(1) of $31.1 million and adjusted EBITDA(1) of $31.8 million.

- Net income for the year of $2.8 million or $0.03 per share, a significant increase from the net income of $257,000 in 2022.

- Adjusted EBITDA(1) per share of $0.35

- An increase in Au recovery for the full year to 88.3% in 2023, up from 87.2% in 2022.

Full Year 2024 Outlook

- Exploration of the expanded property package along the Otu fault to continue to build total resources and identify the next mine on the Company’s Antioquia properties.

- Continue to formalize the operations of small miners working on the Company’s concessions, aiming for 10% of its production to come from these formalized small miners.

- Finalize plans to restart the el Limon Mill to process both excess ore from Cordero and ore from formalized small miners.

- Review further strategic additions to the Company’s concession package, targeting trends identified by its exploration program.

- Drill the Cordero deposit at depth with the new underground drill purchased by the Company to confirm resource continuity and increase resource estimates.

Geoff Hampson, Soma’s President and CEO, states, “2023 was an exceptional year as we achieved significant increases in our gold production and EBITDA. Despite a challenging inflationary environment in Colombia and changes in mining methods, we managed to maintain stable cash costs. Going forward, we expect continued growth in the number of produced ounces, with the Machuca Mine set to come online mid-year. This additional feed material justifies the restart of the el Limon Mill, which has been on care and maintenance as production scaled up. We also anticipate lower mining costs due to the transition from mechanized mining to the conventional raise stope method.”

The Company also announces that it has accepted Javier Cordova’s resignation as CEO, President, and Director of the Board of Soma Gold Corp. and all of its subsidiaries. The Board thanks Javier for his contributions and wishes him the best in his future endeavors.

The Company also announces that it has granted incentive stock options, pursuant to its equity incentive plan, to an employee of the Company to purchase up to 200,000 common shares of the Company. The stock options are exercisable at a price of $0.56 per share for a period of 5 years from the date of grant. The Company also announces that it has awarded an aggregate of 50,000 Restricted Share Units (“RSUs”) under its equity incentive plan to certain non-executive directors of the Company. Each RSU represents a right to receive one common share of the Company following the vesting of such RSUs over a three-year period. The foregoing grants are subject to the approval of the TSX Venture Exchange.

Three and Twelve Months Ended December 31, 2023 and 2022 – Financial and Operating Highlights

ABOUT SOMA GOLD

Soma Gold Corp. (TSXV: SOMA) is a mining company focused on gold production and exploration. The Company owns two adjacent mining properties in Antioquia, Colombia, with a combined milling capacity of 675 tpd. (Permitted for 1,400 tpd). The El Bagre Mill is currently operating and producing. Internally generated funds are being used to finance a regional exploration program.

With a solid commitment to sustainability and community engagement, Soma Gold Corp. is dedicated to achieving excellence in all aspects of its operations.

The Company also owns an exploration property near Tucuma, Para State, Brazil that is currently under option to Ero Copper Corp.

On behalf of the Board of Directors

“C. Geoffrey Hampson”

Chief Executive Officer and President

For further information, please contact Jean Francois Meilleur, telephone: +1-514-951-2730

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

All statements, analysis and other information contained in this press release about anticipated future events or results constitute forward-looking statements. Forward-looking statements are often, but not always, identified by the use of words such as “seek”, “anticipate”, “believe”, “plan”, “estimate”, “expect” and “intend” and statements that an event or result “may”, “will”, “should”, “could” or “might” occur or be achieved and other similar expressions. Forward-looking statements are subject to business and economic risks and uncertainties and other factors that could cause actual results of operations to differ materially from those contained in the forward-looking statements. Forward-looking statements are based on estimates and opinions of management at the date the statements are made. The Company does not undertake any obligation to update forward-looking statements even if circumstances or management’s estimates or opinions should change except as required by applicable laws. Investors should not place undue reliance on forward-looking statements.