November 23, 2022, Vancouver, British Columbia, – Soma Gold Corp. (TSXV: SOMA) (WKN: A2P4DU) (OTC: SMAGF) (the “Company” or “Soma”) is pleased to announce that the Company’s third quarter Financial Statements and MD&A have been filed on SEDAR and are available at the following link: https://bit.ly/SomaQ3Financials.

Highlights of the Quarter

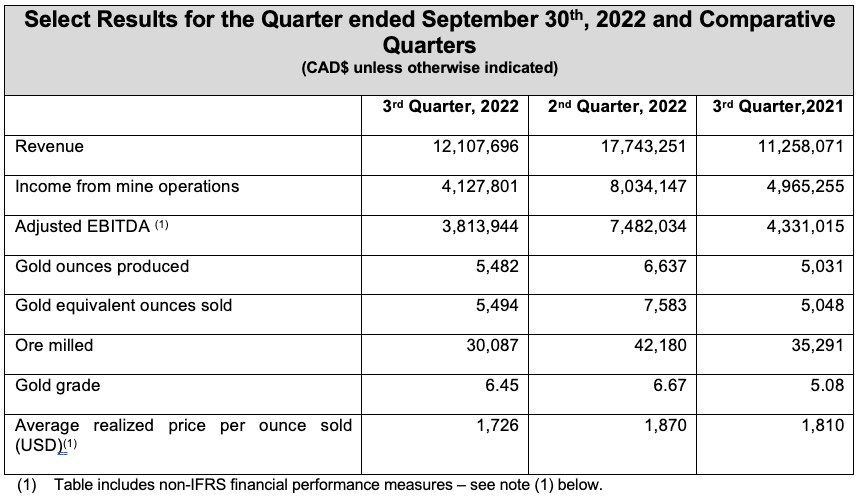

- Gold equivalent ounce sold of 5,494 ounces was the second highest quarterly total in Soma’s history, even after losing one-half of a month’s production to a union strike. Year-to-date, 17,312 gold equivalent ounces have been sold compared to 13,264 in the comparative period.

- The Company’s unionized employees went on strike September 16th. A new collective agreement was successfully reached on September 29th, and the mine and mill quickly ramped up to normal operating levels in early October.

- Income from mining operations was $4.1 million for the quarter and Adjusted EBITDA was $3.8 million. Both metrics were significantly impacted by the strike but are expected to rebound strongly in Q4. Year-to-date, income from mining operations of $16.3 million (2021 – $9.7 million) and Adjusted EBITDA of $15.0 million (2021 – $8.7 million) continue to demonstrate a significant increase over prior year results.

- Development work at Cordero continued to advance with an additional $2.4 million in construction costs capitalized during the quarter ($7.1 million for the nine months ended September 30, 2022).

- Payments were made towards the Company’s gold loan (deferred revenue) of $0.7 million ($2.6 million for the nine months ended September 30, 2022). The remaining outstanding balance has been reduced to $0.9 million at September 30, 2022.

“It was a very busy third quarter for Soma.” Javier Cordova, Soma’s CEO, states. “A new collective bargaining agreement was reached with our unionized employees on September 29th after a two-week strike. Our people are the heart of our operation, and we are pleased to have our many dedicated employees back working towards our mutual success. Despite losing half a month of production, we also achieved the Company’s second-highest gold production to date.” He further states, “Cordero development work continues, aided by further deliveries of the Company’s new underground equipment from Sandvik. The final pieces of equipment were just delivered and are being integrated into our operations. It will allow us to ramp up development and production at the higher-grade Cordero mine and continue to make meaningful increases to our gold production in future quarters.”

ABOUT SOMA GOLD

Soma Gold Corp. (TSXV: SOMA) is a mining company focused on gold production and exploration. The Company owns two adjacent mining properties in Antioquia, Colombia with a combined milling capacity of 675 tpd. (permitted for 1,400 tpd). The El Bagre Mill is currently operating and producing. Internally generated funds are being used to finance a regional exploration program.

The Company also owns an exploration property near Tucuma, Para State, Brazil that is currently under option to Ero Copper Corp.

On behalf of the Board of Directors

“Javier Cordova Unda”

Chief Executive Officer and President

For further information, please contact Andrea Laird, telephone: +1-604-259-0302

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

(1) This news release refers to certain financial measures, such as EBITDA, Adjusted EBITDA, average realized price per ounce of gold sold, and total cash costs per ounce of gold sold which are not measures recognized under IFRS and do not have a standardized meaning prescribed by IFRS. These measures may differ from those made by other companies and accordingly may not be directly comparable to such measures as reported by other companies. These measures have been derived from the Company’s financial statements because the Company believes that they are of benefit in understanding the Company’s results. For a complete explanation of these measures, please refer to Non-IFRS Financial Performance Measures disclosure included in the Company’s MD&A for the Years Ended December 31, 2022 and 2021 and the Three and Nine Months Ended September 30, 2022 and 2021 which can be accessed at www.sedar.com.

All statements, analysis and other information contained in this press release about anticipated future events or results constitute forward-looking statements. Forward-looking statements are often, but not always, identified by the use of words such as “seek”, “anticipate”, “believe”, “plan”, “estimate”, “expect” and “intend” and statements that an event or result “may”, “will”, “should”, “could” or “might” occur or be achieved and other similar expressions. Forward-looking statements are subject to business and economic risks and uncertainties and other factors that could cause actual results of operations to differ materially from those contained in the forward-looking statements. Forward-looking statements are based on estimates and opinions of management at the date the statements are made. The Company does not undertake any obligation to update forward-looking statements even if circumstances or management’s estimates or opinions should change except as required by applicable laws. Investors should not place undue reliance on forward-looking statements.