February 10, 2022, Vancouver, British Columbia, – Soma Gold Corp. (TSXV: SOMA) (WKN: A2P4DU) (OTC: SMAGF) (the “Company” or “Soma”) is pleased to provide a Corporate Update.

Highlights

1. Phase 2 of the 5-year exploration plan conducted in 2022 at the Company’s properties in Antioquia, Colombia has been approved as follows:

- 20,000 meters of drilling, fully funded from cash flow.

- Systematic soil and stream sediment sampling program covering an area of 4,500Ha of land.

- 16.4 km of ground geo-electrical survey for Estrella-Diamantina project.

2. Engaged SLR Consulting (formerly RPA Associates) to update the NI 43-101 Technical Report and Resource Estimates for 29,000 Ha mineral rights concession on the Operadora (El Bagre), Four Points (El Limon) and Zara properties in Antioquia, Colombia.

- Approximately 60,000 meters of new DDH drilling has been completed on the properties since the last report.

- The Cordero Mine has been constructed since the last report.

3. Construction of the Cordero Mine is nearing completion

- The Fenix ramp has accessed Levels 2 and 3, and the production drifts at those levels have been constructed.

- The Atena decline is less than 50 meters from Level 2.

- Presently mining from stopes on Level 2, and mining on Level 3 will begin in February.

- Construction to access Level 5 will be completed by June.

4. Soma has repaid the First Tranche of the NG Gold Loan

- 12% of first 24,500 ounces produced has been paid.

- 6% of next 22,000 ounces will be fully paid by Q4 2022.

2022 EXPLORATION

The El Limon mine, which has historically produced over 250,000 ounces over the life of the mine, sits along the Estrella-Diamantina mineralized trend, which is contained within the Company’s 100%-owned Zara concessions. The land package extends 12km to the south and is on trend with GCM Mining’s (formerly Gran Colombia Gold) Segovia project, which has produced over 1.3 million oz. Au and has MI&I Resources of 2.6 million oz Au. Along the trend, there are a series of small mines that indicate the vein system is present but little modern exploration has been done.

The 2022 exploration plan includes 20,000 meters of drilling for its advanced exploration projects. The drilling plan will focus on two main objectives:

- In-fill and step-out drilling in the south and north end of Estrella-Diamantina mineralized trend (near the Diamantina and La Estrella small-scale mines) and,

- Testing vein and grade continuity in other exploration targets at Limoncito and Cañon de Rojas areas.

Soma has planned 16.4km of ground geo-electrical geophysics for its Estrella-Diamantina project. This geo-electrical survey method has been used to identify ground structures that can be related to quartz vein systems. This survey will outline the possible extension of the mineralized trend and generate relatable data to identify other mineralization at the target site.

Grassroots and early exploration activities including detailed mapping, soil, rock and stream sediment sampling will focus on the under-explored Cañon de Rojas and Porquera-El Quince zones.

ESTRELLA-DIAMANTINA

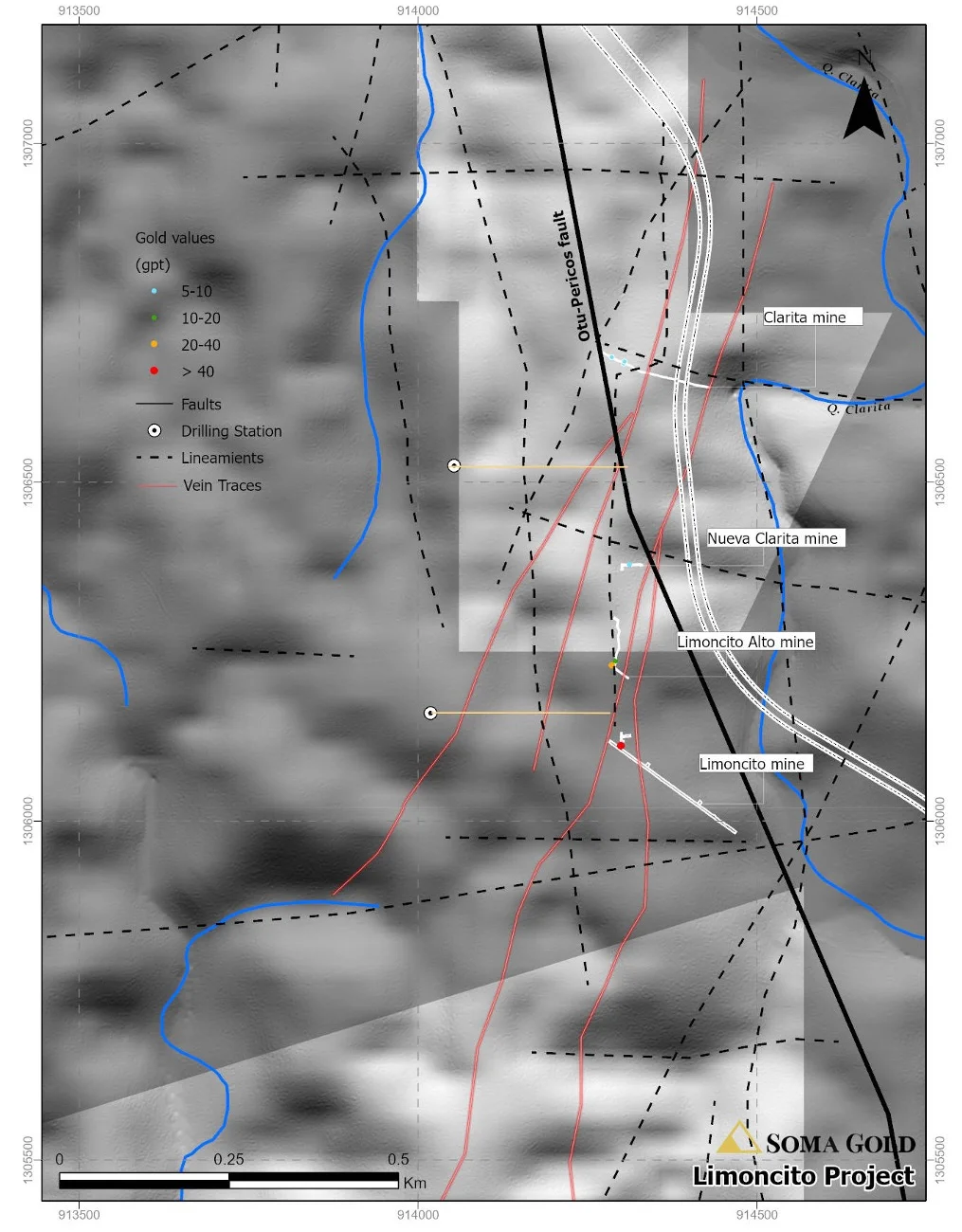

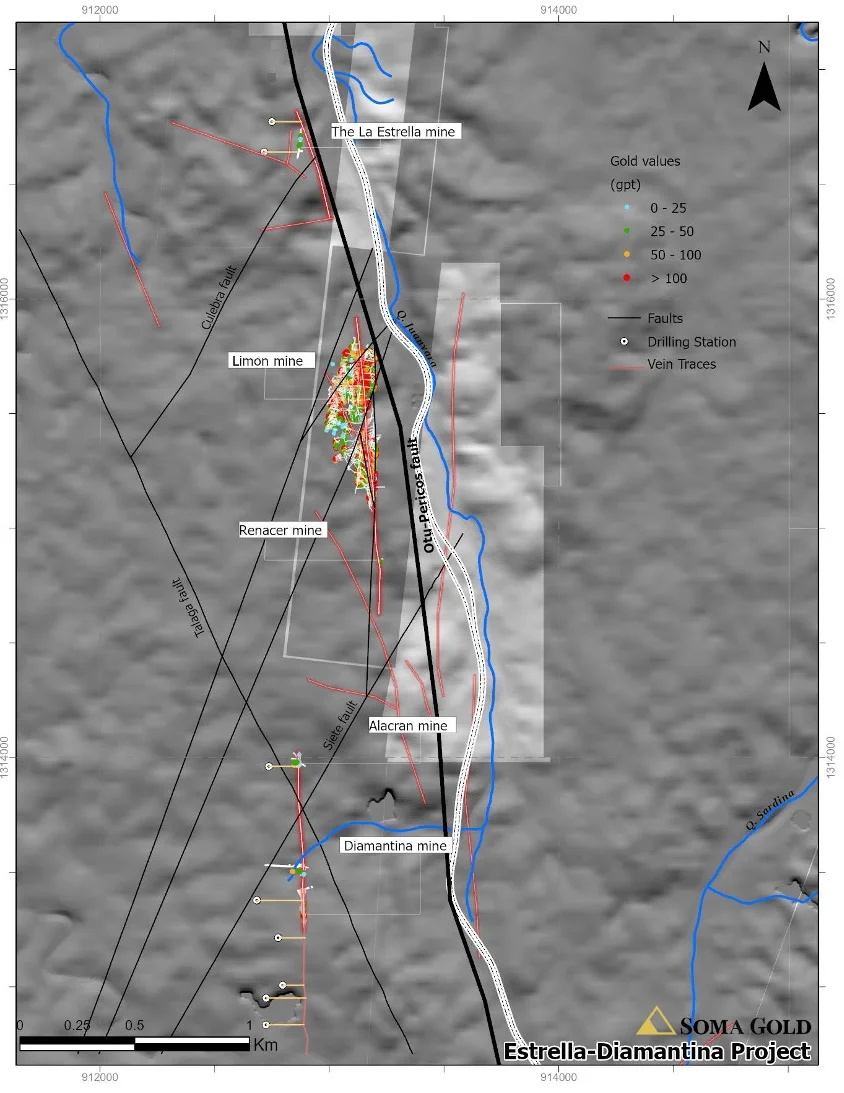

15,000 meters of drilling is planned to expand known mineralization at the south end of the target area and to test vein and grade continuity along strike and down-dip across the +7km long Estrella-Diamantina mineralized trend (see map #1).

Map #1. Plan view of the Estrella-Diamantina project with planned drilling stations, vein traces, faults and gold values.

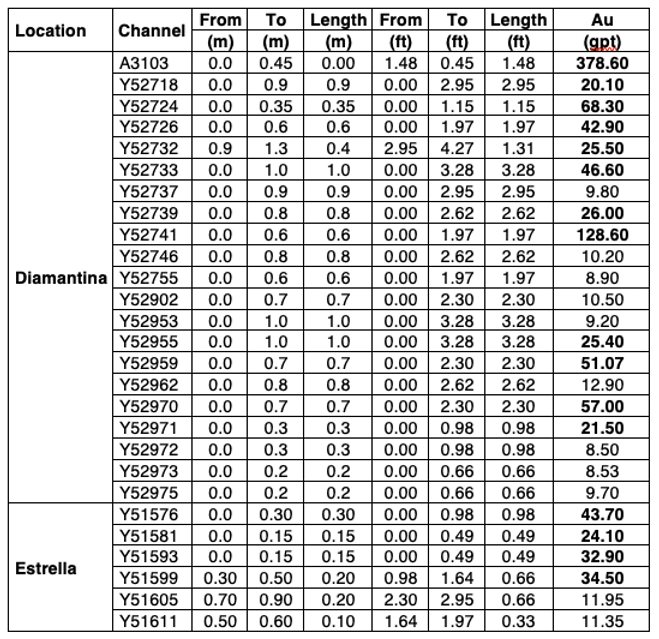

Channel Sampling Results

Channel sampling at the Diamantina and the La Estrella small-scale mines have returned additional high-grade gold values of up to 378.60gpt for the Diamantina mine and 43.70gpt for the La Estrella mine (see Table #1). Previous channel sampling results from Diamantina were reported on April 20 and August 4 of 2021.

Table #1. Channel samples assays.

*Lengths are sampled interval lengths and not necessarily true widths.

Samples were taken in a manner to reflect, as closely as possible, true width.

**Reported only samples with gold grades ≥8gpt

LIMONCITO AND CAÑON DE ROJAS

5,000 meters of initial drilling is planned for these two targets at the south end of Zara’s concessions. The 2021 exploration campaign identified two vein trends: (1) NNE and (2) ENE to WNW. Drilling will be focused on these two mineralized trends to test vein and grade continuity along strike and down-dip.

NNE Trend

This mineralized trend at the Limoncito project (see map #2) consist of milky quartz containing 5-10% of mixed sulphides, dominated by pyrite with sphalerite, arsenopyrite, galena and chalcopyrite. Sulphides distribution within the vein is patchy. Gold mineralization seem to be related to quartz veins with high percentages of sphalerite. The thickness of the vein averages approximately a half-meter. Channel samples taken perpendicular to the vein exposures from small-scale mines along this mineralized trend have returned gold values up to 22.6gpt (previously reported on June 10, 2021).

Map #2. Plan view of Limoncito project with planned drilling stations, vein traces, faults and gold values

WNW Trend

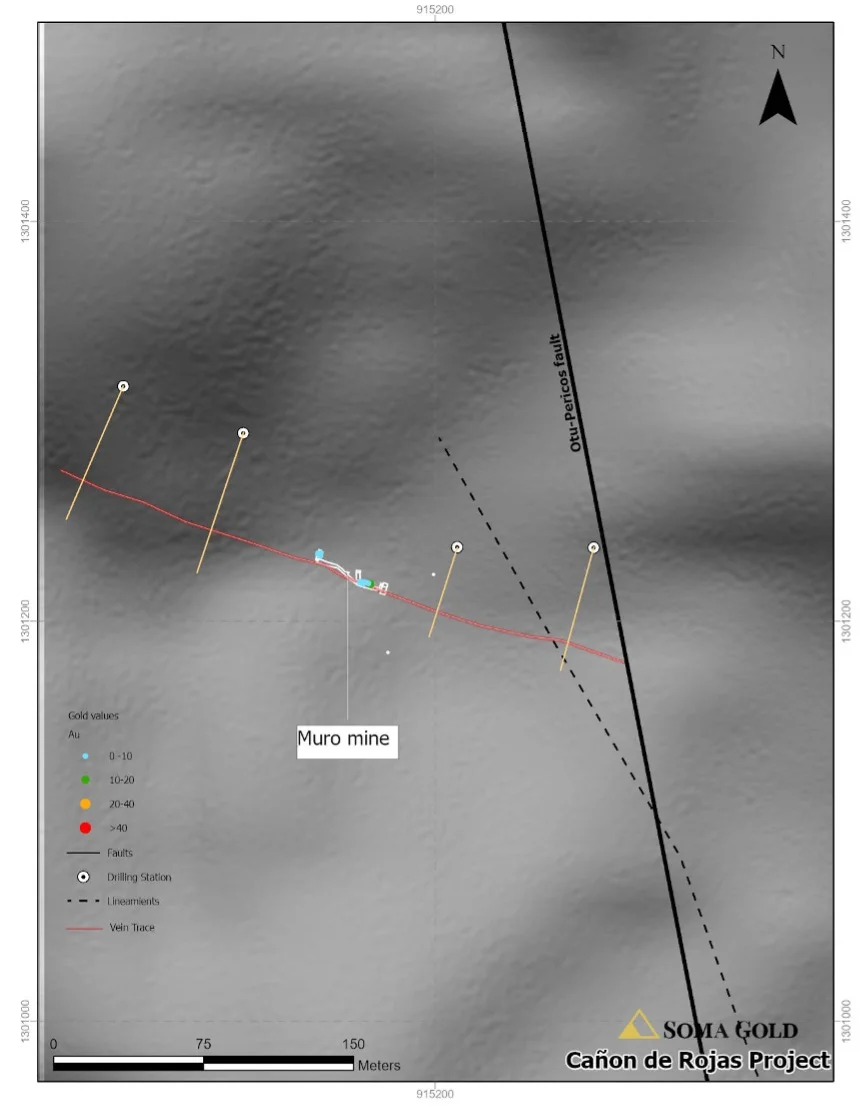

This mineralized trend at Cañon de Rojas project (see map #3) consist of a quartz vein dominated by course-grained pyrite with occasional sphalerite and arsenopyrite. The thickness of the vein averages approximately one meter. Channel samples taken perpendicular to the vein exposures at level 1 of the El Muro mine, have returned gold values up to 16.70gpt (previously reported on June 10, 2021).

Map #3. Plan view of Cañon de Rojas project with planned drilling stations, vein traces, faults and gold values

PORQUERA-EL QUINCE

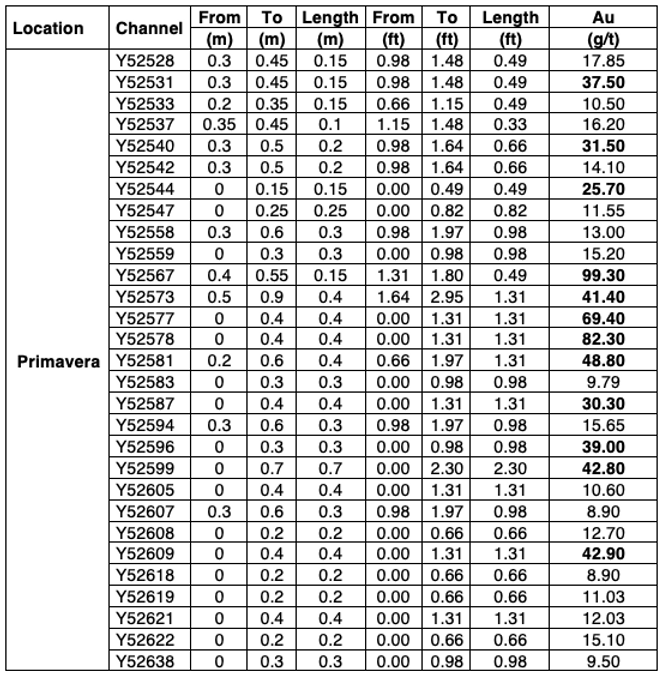

The Porquera-El Quince Zone is located in the central area of Soma’s concessions. In this area, an ENE mineralized trend is mined by small miners at the Amada and Primavera mines. Gold mineralization at Primavera is contained in a N60° trending sigmoidal quartz vein dipping 50° to the south-east with an average vein thickness of 0.4 meters. Sulfide mineralization is characterized by course-grained pyrite, sphalerite and minor chalcopyrite. Channel samples from vein exposures at level 1 of Primavera small-scale mine have returned gold values up to 99.3gpt (see table #2).

Table #2. Channel samples assays.

*Lengths are sampled intervals lengths and not necessarily true widths.

Samples were taken in a manner to reflect, as closely as possible, true width.

**Reported only samples with gold grades ≥8gpt

Javier Cordova, CEO of Soma, states, “There is significant potential for additional high-grade gold discoveries in this under-explored, yet highly mineralized region of Soma’s concessions. Our exploration team in Colombia continues to refine our geological model with an emphasis on understanding the structural controls over the gold grade distribution. Our 2022 exploration plan is designed to provide new information and to potentially identify new gold anomalies on our mining concessions. The 20,000 meters of drilling planned for 2022 is the second year of the 5-year exploration strategy of over 100,000 meters of DDH drilling, soil and stream sediment sampling and geophysics aimed at increasing Soma’s resource to over 750,000 ounces by 2026.”

In accordance with the 5-year Resource Expansion Plan, the Company has engaged SLR Consultants (formerly Roscoe Postle Associates Inc.) to update the resource estimate contained in the NI 43-101 compliant “Technical Report on the El Bagre Operations and Nechi Project, Department of Antioquia, Colombia” prepared by Roscoe Postle Associates Inc. with an effective date of July 31, 2019 and available on Sedar.com. The updated report will take into consideration the approximately 60,000 meters of DDH drilling that has been conducted by the Company over the last two+ years. This drilling has been targeted at an expansion of the resource at Cordero Mine and at the Estrella-Diamantina trend which is on-strike with the historic El Limon Mine.

The Company expects a significant increase in the resource at Cordero, particularly in the Northern Extension of the deposit which has the largest number of drill holes. The Company also expects to include, for the first time, a resource in the Estrella-Diamantina trend where mining activities are currently being conducted by small formalized miners.

The mine development strategy is based on ramping up production to 700 TPD for at least 5 years. That tonnage will allow the Company to restart the el Limon Mill for a combined through put of approximately 650 TPD. With the development of new mines the life of mine will be extended.

To that end, the Cordero mine construction is nearing completion. Mining operations have begun on Level 2 and will commence in February from Level 3. Construction of the spiral ramp to Level 4 and 5 is underway. Access to level 4 is expected in February and to Level 5 by April. Multiple stopes are being planned for each level to increase production to the targeted 700 TPD.

Once the ramp and the development drifts are completed, the Company will self-perform production and future development.

In January 2022, Soma completed the repayment of the first tranche of the NG Gold Loan. The first tranche payments were based on 12% of the first 24,500 ounces produced since the loan was written in September 2020. The last payment under this tranche was made from January 2022 production. This milestone was accomplished 11 months ahead of schedule. The second tranche of the repayment is based on 6% of the next 22,000 ounces produced. The Company expects to complete repayment by Q4 2022.

The reduction in the percentage of production that gets paid to NG positively impacts the Company’s cash flow by approximately US $200,000 per month, and completion of the Cordero Mine construction will also reduce cost by approximately US $300,000 per month. On the revenue side, the newly producing Cordero Mine has a higher targeted average grade of 6.5 gpt compared to the 4.5 gpt average grade the Company milled in 2021. The planned restart of the El Limon Mill will increase milling capacity by 45% to ~650 tpd. The combination of these events are expected to dramatically improve the Company’s cash flow for 2022.

QA/QC CONTROLS

For exploration core drilling, the company applied its standard protocols for sampling and assay. NQ core is sawn or split with one-half shipped to a sample preparation laboratory in Medellin run by ALS Colombia Limited (“ALS”). Channel samples were collected by hand using hammer and chisel perpendicularly across exposed mineralized quartz-carbonate veins to best represent the true width. Channel sample locations were surveyed using total station. Each sample location has been photographed with channel traces painted to indicate the location and orientation of each sample. Samples are then shipped for analysis to an ALS-certified assay laboratory in Toronto, Canada and Lima, Perú. The samples were analyzed for gold using standard fire-assay on a 50-gram sample with an AA finish. Multi-element geochemistry was determined by ICP-MS using either aqua regia (ME-MS41) or four acid (ME-MS61) digestions. Blanks, duplicates and certified reference standards are inserted into the sample stream to monitor laboratory performance. Comparison to control samples and their standard deviations indicates acceptable accuracy of the assays and no detectible contamination. The remainder of the core is stored in a secured storage facility for future assay verification.

Mr. Paulo J. Andrade, P.Geo. BSc., is a Qualified Person within the meaning of National Instrument 43-101. Mr. Andrade is satisfied that the analytical procedures and best practices used are standard industry methodologies, and he has reviewed and approved the technical information disclosed in this news release.

ABOUT SOMA GOLD

Soma Gold Corp. (TSXV: SOMA) is a mining company focused on gold production and exploration. The Company owns two adjacent mining properties in Antioquia, Colombia with a combined milling capacity of 675 tpd. (permitted for 1,400 tpd). The El Bagre Mill is currently operating and producing. Internally generated funds are being used to finance a regional exploration program.

The Company also owns an exploration property near Tucuma, Para State, Brazil that is currently under option to Ero Copper Corp.

On behalf of the Board of Directors

“Javier Cordova Unda”

Chief Executive Officer and President

For further information, please contact Andrea Laird, telephone: +1-604-259-0302

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

All statements, analysis and other information contained in this press release about anticipated future events or results constitute forward-looking statements. Forward-looking statements are often, but not always, identified by the use of words such as “seek”, “anticipate”, “believe”, “plan”, “estimate”, “expect” and “intend” and statements that an event or result “may”, “will”, “should”, “could” or “might” occur or be achieved and other similar expressions. Forward-looking statements are subject to business and economic risks and uncertainties and other factors that could cause actual results of operations to differ materially from those contained in the forward-looking statements. Forward-looking statements are based on estimates and opinions of management at the date the statements are made. The Company does not undertake any obligation to update forward-looking statements even if circumstances or management’s estimates or opinions should change except as required by applicable laws. Investors should not place undue reliance on forward-looking statements.