November 25, 2021, Vancouver, British Columbia, – Soma Gold Corp. (TSXV: SOMA) (WKN: A2P4DU) (OTC: SMAGF) (the “Company” or “Soma”) is pleased to announce that the Q3 2021 Financial Statements and MD&A have been filed on SEDAR and are available at the following link: www.sedar.com (https://bit.ly/3nVdVXv)

Highlights of the Quarter

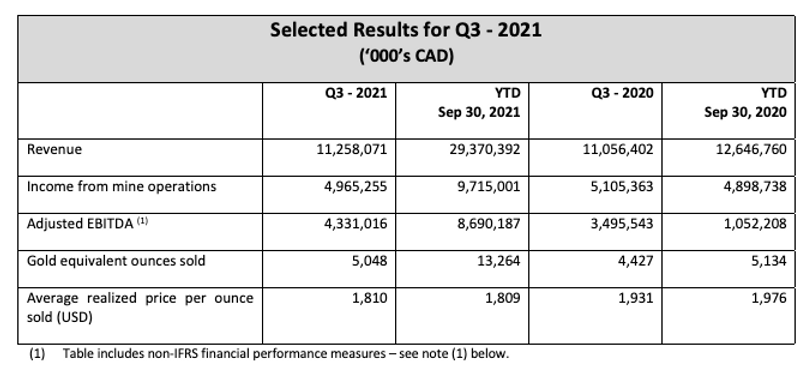

- Income from mining operations for Q3 – 2021 was $5.0 million and YTD was $9.7 million.

- Gross Revenue for the Quarter was $11.3 million and YTD was $29.4 million.

- Total cash costs per ounce of Au sold(1) in the Quarter was USD $884 and YTD was USD $1,072.

- Mineralized material mined during the Quarter was 38,204 tonnes and material processed was 35,291 tonnes.

- Fenix Portal Reaches Cordero Deposit – The Fenix portal has reached the target vein at both Level 2 (announced July 2021) and Level 3 (announced November 2021). First ore from the Cordero Mine was processed in August 2021. Development work continues, and Cordero is expected to produce at ~600 TPD once production ramps up in Q2 – 2022. It is anticipated that this additional through-put will justify the restart of the Company’s el Limon mill.

- COVID Vaccinations – In July 2021, the Company announced that it is participating in a program initiated by leading Colombian companies in cooperation with the Colombian Government to provide Covid-19 vaccinations to its employees working at the Company’s El Bagre mine site and their families. The program includes acquiring, importing and administering the COVID vaccines at a clinic in El Bagre.

“Development work at Cordero made excellent progress – achieving critical milestones as the Fenix decline reached the deposit on both Level 2 and Level 3,” states Javier Cordova, Soma’s CEO. “As a result, Q3 production and financial results compare favourably to the previous quarter as some of the initial development ore from Cordero was brought to the mill. We anticipate further significant improvements as the Cordero development continues and mining from production stopes commences towards the end of the year. Full production of ~600 TPD at an average head grade of 6.5 gpt is expected to be achieved in Q2-2022, which will allow us to restart the Company’s second mill, el Limon. The increase in both, the tons milled and average grade, should result in a significant increase in the monthly gold production.”

Mr. Edwin Naranjo Sierra, FAusIMM, MSc, Senior geologist, Director of Exploration for Soma Gold Corp is the Qualified Person, within the meaning of NI 43-101. Mr. Naranjo is satisfied that the analytical procedures and best practices used are standard industry methodologies, and he has reviewed and approved the technical information disclosed in this news release.

ABOUT SOMA GOLD

Soma Gold Corp. (TSXV: SOMA) is a mining company focused on gold production and exploration. The Company owns two adjacent mining properties in Antioquia, Colombia with a combined milling capacity of 675 tpd. (permitted for 1,400 tpd). The El Bagre Mill is currently operating and producing. Internally generated funds are being used to finance a regional exploration program.

The Company also owns an exploration and development property near Tucuma, Para State, Brazil.

On behalf of the Board of Directors

“Javier Cordova Unda”

Chief Executive Officer and President

For further information, please contact Andrea Laird, telephone: +1-604-259-0302

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

(1) This news release refers to certain financial measures, such as EBITDA, Adjusted EBITDA, average realized price per ounce of gold sold, and total cash costs per ounce of gold sold which are not measures recognized under IFRS and do not have a standardized meaning prescribed by IFRS. These measures may differ from those made by other companies and accordingly may not be directly comparable to such measures as reported by other companies. These measures have been derived from the Company’s financial statements because the Company believes that they are of benefit in understanding the Company’s results. For a complete explanation of these measures, please refer to Non-IFRS Financial Performance Measures disclosure included in the Company’s MD&A for the Three and Nine Months Ended September 30, 2021 and 2020, which can be accessed at www.sedar.com.

All statements, analysis and other information contained in this press release about anticipated future events or results constitute forward-looking statements. Forward-looking statements are often, but not always, identified by the use of words such as “seek”, “anticipate”, “believe”, “plan”, “estimate”, “expect” and “intend” and statements that an event or result “may”, “will”, “should”, “could” or “might” occur or be achieved and other similar expressions. Forward-looking statements are subject to business and economic risks and uncertainties and other factors that could cause actual results of operations to differ materially from those contained in the forward-looking statements. Forward-looking statements are based on estimates and opinions of management at the date the statements are made. The Company does not undertake any obligation to update forward-looking statements even if circumstances or management’s estimates or opinions should change except as required by applicable laws. Investors should not place undue reliance on forward-looking statements.